Welcome to the DCTC Library's personal finance guide. On these pages you will find library resources (both online and on our shelves), plus other reliable online resources.

Let's get started!

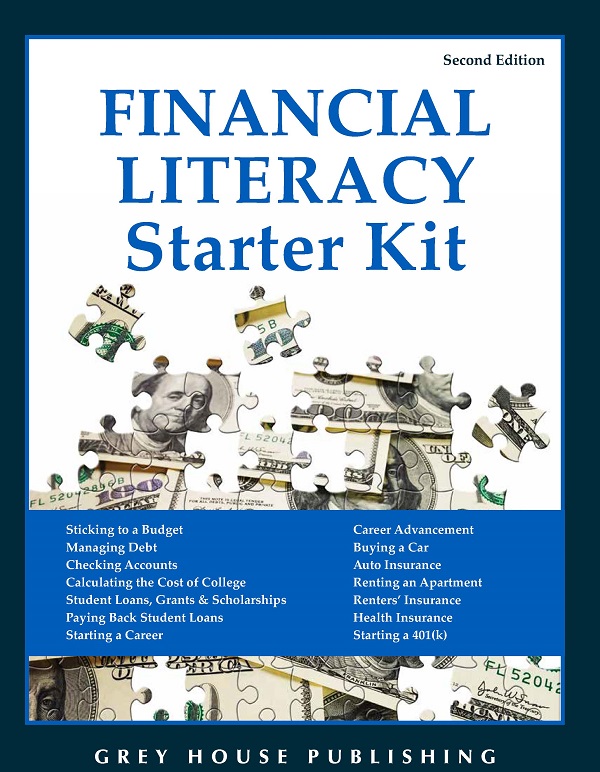

The Financial Literacy Starter Kit provides guidance on how to make a budget, manage debt, rent an apartment, buy a car, manage a checking account, calculate the cost of college, pay back student loans, get career advice, and more. You can find the Financial Literacy Starter Kit in our Reference collection or online.

The Financial Literacy Starter Kit provides guidance on how to make a budget, manage debt, rent an apartment, buy a car, manage a checking account, calculate the cost of college, pay back student loans, get career advice, and more. You can find the Financial Literacy Starter Kit in our Reference collection or online.

Films On Demand features Personal Finance Essentials: Financial Literacy for Young Earners, a five-part video series on personal finance.

Films On Demand features Personal Finance Essentials: Financial Literacy for Young Earners, a five-part video series on personal finance.

- Budgeting and Financial Decision Making (36:26)

- Checking Accounts and Everyday Banking (31:27)

- Credit, Borrowing, and Debt (35:42)

- Saving and Investing (32:25)

- Taxes and Tax Benefits (32:02)

Other videos include:

- Personal Finance: When Am I Ever Going to Use This? (25:20)

- Budgeting: Because Money Still Matters (22:35)

- Dealing With Debt: Because Money Still Matters (19:54)

- Living Expenses: Because Money Still Matters (19:24)

- Fighting the Impulse to Spend (18:29)

- The Monster of Debt (18:14)

- Credit Cards, Friend or Foe? (17:38)

- Financial Emergencies (16:14)

- Budgeting 101 (13:35)

- Credit Scores, the Good, the Bad, the Ugly (13:38)

- Buying a Car (18:54)

- Staying out of Debt (14:30)

- Your Financial Future (14:49)

Here are just a few of the ebooks about personal finance you'll find in our EBSCO eBook Collection:

Financial Intimacy: How to Create a Healthy Relationship with Your Money and Your Mate

Financial Intimacy: How to Create a Healthy Relationship with Your Money and Your Mate

Jacquette M. Timmons, 2010

Map Your Financial Freedom: Charting a Course Through Adulthood and Retirement

Map Your Financial Freedom: Charting a Course Through Adulthood and Retirement

Patrick A. Lyons, 2009

Mastery Of Money For Students

Mastery Of Money For Students

Adam Carroll, 2019

Credit Repair: Make a Plan, Improve Your Credit, Avoid Scams

Credit Repair: Make a Plan, Improve Your Credit, Avoid Scams

Amy Loftsgordon, 2017

Graduate From College Debt-Free: Get Your Degree With Money In The Bank

Graduate From College Debt-Free: Get Your Degree With Money In The Bank

Bart Astor, 2016

Our collection is organized by Library of Congress call numbers. If you like to browse, most books about personal finance are shelved in the HG179 call number range. Ask a librarian if you need help finding anything.

Here are just a few of our books about personal finance:

Use our catalog, OneSearch, to find the books and videos on our shelves, plus ebooks and streaming videos.

The best way to begin your search is to enter one or two keywords on your topic. To narrow your results, use the Modify My Results options on the left side of the screen. You can also click on a relevant title and click on one of its subject headings to focus your search on that particular topic.

Please ask a librarian if you need help locating anything you find in our catalog.

If we don't have the book, video, or article you're looking for, you can request it via interlibrary loan (ILL) and it will come to you. It's easy! E-mail library@dctc.edu to let us know what you're looking for and we'll do the rest.

The Financial Literacy Starter Kit provides guidance on how to make a budget, manage debt, rent an apartment, buy a car, manage a checking account, calculate the cost of college, pay back student loans, get career advice, and more. You can find the Financial Literacy Starter Kit in our Reference collection or online.

The Financial Literacy Starter Kit provides guidance on how to make a budget, manage debt, rent an apartment, buy a car, manage a checking account, calculate the cost of college, pay back student loans, get career advice, and more. You can find the Financial Literacy Starter Kit in our Reference collection or online.

These magazines can help you make smart choices with your money.

We have print issues of Consumer Reports from the past three years, plus online coverage from 1991 to the present via EBSCO.

We have print issues of Consumer Reports from the past three years, plus online coverage from 1991 to the present via EBSCO.

We have print issues of Kiplinger's Personal Finance from the past three years, plus online coverage from 1990 to the present via EBSCO.

We have print issues of Kiplinger's Personal Finance from the past three years, plus online coverage from 1990 to the present via EBSCO.

FederalStudentAid.gov offers a handy guide to Budgeting for college students. It covers why and how to create a budget, how to balance school and a job, and what you should know about budgeting after you graduate.

The Consumer Financial Protection Bureau provides a ton of useful information and answers to commonly-asked financial questions in their Consumer Tools. Topics include:

- Auto loans

- Bank accounts and services

- Credit cards

- Credit reports and scores

- Debt collection

- Fraud and scams

- Money transfers

- Mortgages

- Payday loans

- Prepaid cards

- Reverse mortgages

- Student loans

You'll also find guides for financial decisions like helping a loved one manage their money and paying for college.

Investopedia offers lots of Personal Finance information, covering budgeting, savings, banking, credit cards, debt, home ownership, retirement planning, taxes, insurance, and more. You'll also find The Ultimate Guide to Financial Literacy, which introduces banking and credit cards and explains how to create a budget and start investing.

MoneyGeek offers advice and tools to help you make personal finance decisions. Topics include:

- Bad Credit Car Loans: What to Do When You Need a Car but Have Poor Credit

- Small Business Loans: How to Research, Apply for and Get Financing

- Compound Interest Calculator

- Cost of Living Calculator

- Cash-Back Credit Cards

- How to Prevent Credit Card Fraud

- Guide to Getting Your First Credit Card

- Credit Card Debt-Free: How to Face Facts, Save Money and Get that Balance Paid

- Let It Save: Your Ultimate Holiday Budget Plan

- Are You Financially Literate?

- A Financial Literacy Handbook for All Life Stages

- The Ultimate Guide to Budgeting

- Beginner’s Guide to Personal Finance

- Tax Guide for Military Members & Veterans

- Guide to Retirement Planning

- Becoming a Money-Wise Woman: A Guide to Financial Independence

- Creating an Affordable, Healthy Diet That Works for You

- The Cheapest Car Insurance in Minnesota

- A Guide to Renting for People With Disabilities

- Mortgage Calculator

- Fighting Housing Insecurity in the US

- How To Make Your Home More Accessible

Smart About Money is a program of the National Endowment for Financial Education and features free online courses with worksheets, calculators and quizzes. Each course takes about 45 minutes to complete. The Money Basics courses cover Spending and Saving, Credit and Debt, Insurance, Investing, and Employment.

LearnFree.org offers tutorials on many topics, including Money Basics. Lessons include:

The Federal Trade Commission provides Consumer Information on a wide variety of topics, including:

- Shopping & Saving

- Credit & Loans

- Dealing with Debt

- Saving Energy at Home

- Healthy Living

- Job Hunting

- Going into Business

- Identity Theft

- Scams

You'll also find guides on how to File a Consumer Complaint, Report Identity Theft, and Get Your Free Credit Report.

The Department of Labor (DOL) runs a retirement savings education campaign called Saving Matters, with information about why you should begin saving for retirement now and tips for getting started. DOL's Employee Benefits Security Administration also provides publications like these: